Click here to see other articles on Chaos Agents. Some more active conversation about topics such as this can be found at the RTE Locals channel.

Yesterday, I wrote a brief critique of Steve Kirsch's hedge fund plans. Some of what was behind a paywall will be reiterated in this more thorough, fully public article that aims to be both comprehensive and at least a little entertaining (but probably not). This is one of those articles that I encourage you to share with those who may have sauntered up to the stage to make hundred dollar bills rain on Steve.

https://roundingtheearth.substack.com/p/kirsch-capital-equities-fund-buyer

Having had time to communicate just a little with Steve (who answered none of my concerns), talk with several others with experience with (either with Steve or) the hedge fund industry, and mull all of this over, I wanted to write a second article. A $100 million fund is serious business. It's even more serious at this moment for multiple reasons:

We seem to be heading into a massive market correction.

We seem to be heading into a massive reorganization of the global economy.

It's not clear whether the dollar will collapse sooner rather than later.

Hedge fund work is complex territory.

Pooling the names (and wealth) of wealthy dissidents has a very bad history.

Steve's plan strikes me as terrible during good times when all these other factors aren't in play.

Steve has relationships with numerous billionaires (worth hundreds of billions), but needs money from Substack readers?

Other shenanigans.

Also, there's something weird and creepy about forming long-term wealth pools with the money of thousands of people at this moment in time. I'm all about ordinary market participation, and working for greater rewards, and I've never been one to point at a lot of things and declare "Inappropriate!", but…

I want to make this clear moving forward: Probably 50 or more RTE readers have written to me over the past two years asking if I would invest their money (which would likely mean starting a hedge fund). Steve asked me in 2021 if I would be interested in running his fund. That was the seventh time in my life I've been asked to run a hedge fund, and every time I've said "no". And that's not because I'm allergic to money. It's because I take money—a representation of people's labor—very seriously. I would only take on the task of managing money under the right circumstances, and in most cases I would rather be the educator who helps people better understand finance and economics for themselves.

Even then, I am known for constantly giving advice such as, "Don't trade [unless you're an exceptional personality and mind for the job, and fully understand the market]." After I had a great run trading in 2017 and 2018, I started working on a book on how to trade cryptocurrency well. But I kept running into the fact that my real advice to almost any reader was, "Don't trade."

Several dozen paid RTE subscribers are members of my Bitcoin Education Squad. I believe that all of them will say that I'm consistent in my warnings about trading and investment. As others in the group wanted to talk about trading in a way that I felt was not generally responsible, I politely asked those people to create a different group. The main offender did so, and we are still friends.

The idea of people losing their money in fool's games simply makes me ill. That's half the reason I took the social risk of critiquing the circus around Ed Dowd's "Big Short" (even though I have no reason to believe he's a bad guy after grilling him, and I've talked to people I trust who say he's a good guy). I just felt that somebody around him likely set up a pump-and-dump in the options market. Identifying those scenarios is how I built a trading account up to 40,000% profit in about three-and-a-half years.

https://roundingtheearth.substack.com/p/the-big-short-a-warning-about-ed

Did anyone in the world claim to profit from buying Pharma puts, and provide receipts?

I don't care that I'll receive three to twenty emails telling me what an awful and terrible person I am for sharing my thoughts. And I'm happy to discuss the facts—I can be wrong. But this is a situation in which I see a bull in a china shop while 2,000 people are lined up to deposit their china (if the analogy doesn't fully make sense, that's because neither do the circumstances).

These Conditions are Terrible for Most Investment Funds

Was there ever a year prior to 2021 when only seven of the top 20 stock traders in Congress added to their positions in net? Does that tell you anything important about market conditions?

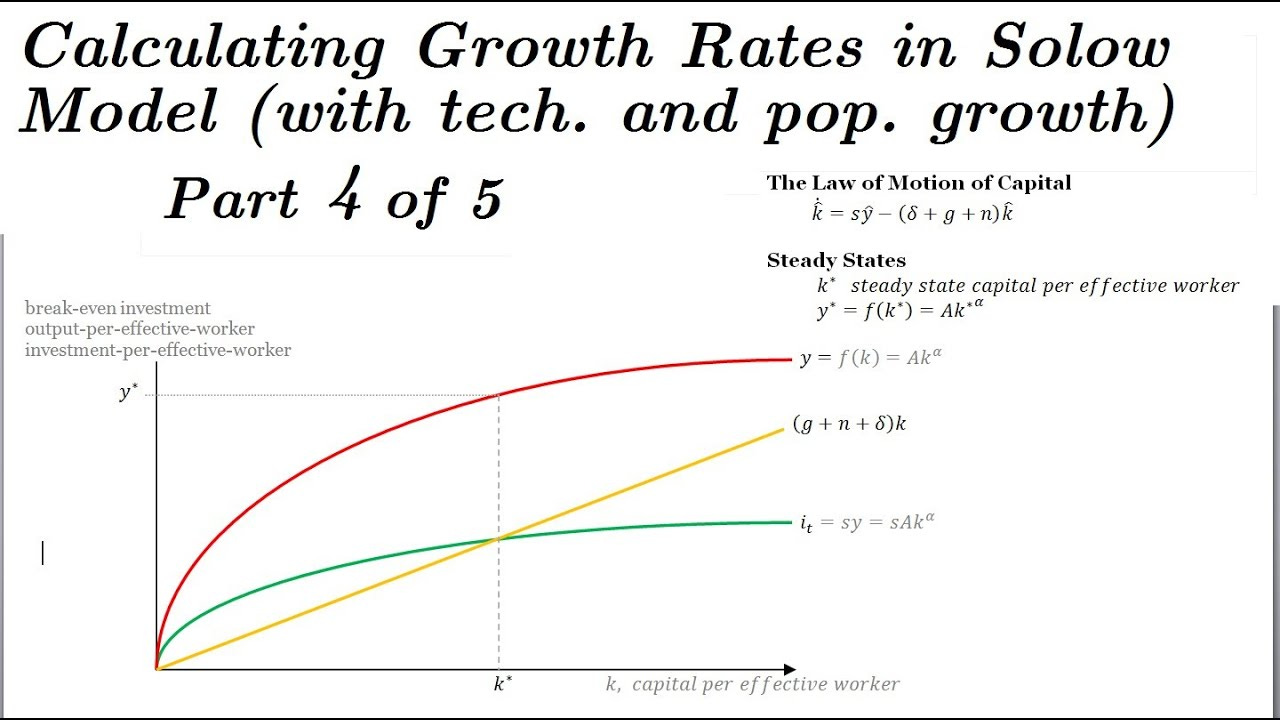

I could deposit a whole lot of additional words here, but if you're reading, you're probably aware that the world is in dramatic upheaval. If you need a whole lotta words, I've written more than a few (and a lot of these apply as well). But let's start in the present moment. What do you see in this chart?

Does this chart scream, "Great time to lock up my capital in somebody else's investment vehicle with a big target on your back!?"

Or does it scream, "We may all be better off leaving the casino!?"

I get it: You're anxious. You're scared. You stay up nights wondering what the Nazis have in store. You would love to have some way to grow your capital while passing some of the profits to a worthy cause. You wonder if the world is spinning faster. You wonder why the difference between "The CIA helped murder JFK" and "the Earth is flat" suddenly seem a little blurrier.

A word of advice: If you can't see straight when the bar is closing, don't go home with anyone, and don't take anyone home. Wake up tomorrow, drink some coffee, then sit on a nice park bench and think through whom you want to mingle genetic material with. Very. Carefully. One misstep, and you can't be certain whether you correctly count two nipples, or three.

The dollar has been on a stable trajectory toward near-zero buying power for decades. You might ask how much value $100 million will lose sitting in a fund while potential profits (if there are any) are largely soaked up by a nonprofit that may or may not achieve any goals. It's worth repeating: I'm not just saying that Steve's hedge fund idea is a terrible one—I think that very few hedge fund investors will be particularly happy over the coming years. A scarce few will understand whether the prices of puts are expensive, much less time their put buys just right.

Let's be clear: hedge fund work is the financial equivalent of surgery. Do you want to undergo surgery on the battlefield? Do you want your surgeon to be a Silicon Valley tech CEO who woke up at retirement age, quit the Rockefeller mafia, and came to Jesus several months into a war, said, "Jabs bad" loudly and often, bought a prop kitten, still wears the Central Bank Digital Currency company shirt, and then suddenly decided to raise money by bypassing medical school to become a surgeon?

I'm not saying that Steve Kirsch is a bad actor, but I'm saying that maybe there are things that the community can trust him with, and other things that seem less than wise to trust him with. And also that he may not actually know the difference, or even be equipped to know the difference.

Sometimes, it's best to avoid mistakes without experiencing them.

What Do Other Market Professionals Think?

Understand that I have a fairly deep pool of friends and acquaintances to talk with who have either worked at the most successful hedge funds (like D.E. Shaw or Susquehanna where I traded and later head hunted young recruits, Renaissance where I know the top quant and others, or Janestreet where numerous of my former students have gone), or run their own hedge funds (Hi Mike, Gilda, George, Michelle, and sorry anyone reading whose name I skipped), prop trading groups (Hi Bill and John), or personal funds (my preferred route). I thought I might talk to a few of them, but I've talked to just one. I quickly realized that I was not going to hear anything more exuberant than, "Well, this seems not well thought out," with respect to Steve's plans.

I noticed the following comment on Steve's hedge fund announcement. Sid is the inventor of the ETF, and a highly experienced financial mathematician. While we don't agree on all the specifics of what would be a good trade or investment right now (that's a very tough conversation in this environment, and it would be hard to get full agreement in a room full of smart people), it is evidence that top minds with domain expertise find plenty that is unpalatable about Steve's plans.

If you're a market professional—particularly one with hedge fund experience, I'd be curious to hear your take. Are you throwing your own money in? Aside from any of the other information in this article, where would you rank Steve's plan among investments at your disposal?

The Questionable Kirsch

The world's richest man is one of the two of the largest donors to Steve Kirsch's COVID-19 Early Treatment Fund. The largest outside donor is billionaire Jeffrey Skoll, who sets aside a large portion of his wealth in a foundation to fund social entrepreneurship. Another is a multi-billionaire pandemic profiteer who co-funded the University of Minnesota trials with Steve that sank hydroxychloroquine. There are other highly wealthy donors as well. As vocal as Steve has been about vaccines, it amazes me that he doesn't unravel all the bullshit behind those trials. Early Treatment Fund indeed.

Has Steve picked up the phone to ask these gentlemen how much they'd like to contribute to his fund of funds? Elon Musk probably sweats a million dollars a day. There are probably hundred dollar bills in his belly button lint.

Has Steve called up the Zelenko vitamins billionaire? I hear he's sold north of $100 million in vitamins at over 1000% markup. Let me know if I have that number wrong—it might be higher now.

Has Steve reached out to the Bitcoin billionaires who funded the Global COVID Summit to offer them into the investment pool?

If he didn't bother, isn't that interesting? If they all said, "No, thanks," is that a signal?

There is so much that smells…off in this kitchen that I don't think it suffices to check the milk. Are you picking up what I'm laying down here?

While my critique of Kirsch's fund of funds wasn't exactly made with kid gloves on, it was an honest and straight-forward critique. Steve's response was not to answer any of my numerous concerns, but to simply announce that I'd written a "hit piece" on him. I have seen hit pieces written on Steve, but let's be clear: only a fool would dismiss many valid concerns over this amount of money. I am sticking to the facts, and making it clear what is my judgment and opinion, and Steve doesn't address any of that. It's not just that he plays the victim card, but he only plays the victim card.

This is the same man who daily lambasts public health officials for not addressing real concerns and dangers. Did he generate all this public popularity, with over a million people reading his substack, just to be in the same position of not having to answer questions about plans with enormous risk?

Steve's primary pushback might be framed as, "I'm doing this because there is no better idea." This is a classic tu quoque fallacy.

Over the past 21 months, I've spent hours talking finance with Steve, and in almost every conversation I felt as though I were talking with somebody with little enough knowledge and experience to be maximally overconfident. Even worse, if my thoughts didn't align with his desire to have a dazzling, unassailable plan, it felt like he just wanted to stop listening and get off the phone—like he didn't have time to be considerate in learning what he would need to learn to make any plan a good one. I'm sure this can be framed as an "attack", but it's a position that I reviewed personally many times as Steve's odd behaviors and decisions mounted.

During the first 11 months I knew Steve, he never even inquired how I took my trading account 400x, and when I did briefly consult for him in April of last year, his advisor seemed anxious through the conversation to just end it. I saw no indication that either of them were ready to learn about serious trading discipline and strategy. This was shortly after Steve wrote bragging about being up 5.63% during March of last year. That week I warned him about Crypto Winter and the inevitable rug pull of the yield farming tent (the one that gave FTX rug burn), and Steve still fell into that trap to lose millions.

Has Steve published his personal trading/investing returns to date?

What does it tell us that he has people lined up to invest without that kind of detail?

I also put Steve in contact with a now-retired computer scientist who successfully built an algorithmic-based A.I. hedge fund. I could have put him in touch with quality traders and quants in any financial discipline, though I felt more and more reticent about sharing my rolodex.

Apparently since my brief consultation for the Kirsch Capital team, they simply defaulted to "fund of funds" instead. And while he complains that nobody is offering better ideas, he stopped seeking my advice, which I interpret as not having the attention span for the level of detail necessary to succeed in the hedge fund world.

Also, I keep scratching my head wondering why a tech CEO who has amassed hundreds of millions by building companies doesn't prefer to focus on market building rather than market playing. If he can't find a field worth building in, doesn't that tell him something stark about the broader market?

Let's see…fields worth investing in…

Education. I hear the home schooling market is booming. Also, I know some people who know some people…

Why not simply crowd-fund a medical trial or two? Why is locking up $100 million a necessary step in the process?

Virtopsy services, which was one of my unanswered complaints about relying on one embalmer to witness about 100 others saying the clots are real. Why not let families pay a fee to find out, film it, and compile the data as a for profit venture that partially funds VSRF?

A new hospital. I've heard a rumor (that I believe given other information consistent with the claim) that AFLDs is missing $30 million in funds. Wasn't that money supposed to go toward building a new hospital network? Or…maybe just one place where the vaccine-injured wouldn't be subjected to gas lighting?

How about my idea for a distributed medical data system?

How about a new scientific publishing system on a crypto-rail?

How about the manufacturing of antibiotics since more than 95% of ours are made in China, and it smells like the feces hit the fan already?

How about a textbook publishing company that writes books that don't brainwash people into false histories and false science? I guess that's just one of the many versions of "education" that I outlined.

How about an AirBnB competitor with encrypted personal keys so that one company isn't dominating a centralized information pool that they can exploit or that can be breached? Would *anyone* not switch over?

An agriculture bank (throw in educational services) that helps farmers control their output, which usually gets sucked into the corporate system that pressures them to plant unhealthy crops for unhealthy foods, and to vaccinate (which generally entails post-vaccination antibiotics) animals.

A logistics company that helps truckers maintain their autonomy (most of the logistics firms have undergone mass consolidation, leaving the community politically helpless—which may be why the People's Convoy was so easily sabotaged).

Even intentional community real estate investment might be a quality niche market for a few years as wiser people in this ecosystem look for functional places to live.

This isn't even hard. Sometimes for meditation, I sit with a notebook and just imagine what people need, Pareto improvements to systems, or which companies are the most predatory. And if the goal is to gain more funds than Steve generates with his Substack, a three-year time horizon can involve selling stock out gradually to new investors, a bit at a time.

And Steve had my advice for free (though he constantly asked the wrong questions, and ignored constructive paths).

https://twitter.com/SmallEmbersArt/status/1626415857227161602?s=20

And if there are no positive financial feedback loops that empower people, then taking $100 million of investment capital and pouring that into the current power base seems like a truly terrible idea from the outset!

Steve loves to bet, and prods those he challenges as if they're cowards. So…

I'll wager that Bitcoin out-returns Steve's fund of funds in 2023, too.

Amazingly, despite his history of ignoring my (usually free) advice within my domain experience, Steve blames me for his lack of due diligence.

But did I save him a headache? I suspect I saved the headaches of some potential investors. I've been thanked a few times over the past 24 hours. But after all of Steve's questionable behavior, I have to wonder aloud whether Steve's goal is to make millions for the VSRF, or to tie up the capital of thousands of people while the global economy that fuels the markets is strangled.

Suppose that I'm wrong, and that Steve has done far more due diligence than I've imagined or observed. Then why hasn't he told his audience, "I know that these well-earning hedge funds will take money, and specifically also the money of anti-vax dissidents, because I've talked to X, Y, and Z on the phone?" Can he at least tell us that he won't be taking fees to place capital, because that's how (I've heard, ahem) some of these funds of funds operate.

Has he posted hedge fund earnings distributions, or displayed analysis on how many funds actually beat the market consistently?

Has he shared the results of other funds of funds (which have historically failed to beat the market, meaning that buying a simple ETF would have outperformed with lower fees)?

Steve's announcement makes a bold claim.

It's just so simple that he never bothered to build his own hedge fund before. Or wait, is he saying that he is currently operating a fund, stating the past performances of the funds they chose, but not sharing any information on how those funds have performed since he invested in them?!

I'm going to share a little secret with you. This is hard won experience from Wall Street. Are you ready for it? Fact: There are a small handful of hedge funds that monopolize top talent, and achieve outsized gains over the years. You might be able to count them on one hand. And neither you, nor I, nor Steve Kirsch can invest in them.

Almost all the other firms that even beat the broad market by even a notch over any long term are performing criminal acts, like sharing returns with medical trial reviewers who tip them with unpublished results. Will Steve know how to distinguish between them? Will he care to try? So far, I don't see basic due diligence, much less an ethical foundation for the process.

But hey, we can just leap all the way to "win-win" ahead of time, and a vaguely outlined mission of "truth".

You Do Not Need Steve Kirsch to Lead You

Save me the weird "Unity" nonsense where I'm supposed to remain silent about crazy behavior, people in the medical freedom movement in trucks full of guns at trucker rallies, apparent fraudulent grifting, or all the other sort of information that rational people might want to apply to important decisions. But if you want "unity" at the cost of information and agency, I'm fairly sure the status quo is moving in that direction, already. I bid you good luck following the other herd outside the herd.

Investing with Steve means putting your money into a pool pre-labeled "anti-vax dissident". And while I don't mind personal smears so much (I lean toward, "What Do You Care What Other People Think?"), it seems unwise to run through the halls of the banking system with a target on your back. You could lose more than your money.

And I do have an alternative (aside from the potential business plans, or just crowd-funding some operations, so lots of alternatives). Here goes…

You need to step up and be your own leader. You are more capable than you know. We have all been targeted with methods for suppressing that confidence, and from multiple directions. Strangely, Steve never figured that out while working with the Rockefeller Foundation until after the COVID-19 quasi-vaccines were already on their unstoppable march.

You be the leader that you need. Step up. You have your own unique set of strengths and skills. Start identifying the ways to employ them outside of the framework of the corrupted games. It doesn't matter if you can't see good bets to make right now. Hold your chip stack tight, and don't play a hand until you can identify the edge yourself. And don't trust anyone telling you how well they can play that hand for you—most especially if they've never played that game (that makes sense, right?).

Instead of following the herd outside of the herd, lead your family and your community. Your family is counting on you. Your community is counting on you. The trappings of liberty afforded by a Constitutional Republic are dependent on you. Every human being with a soul who doesn't want the Globalist Nazi Party to accrue more power is counting on you. Change is coming. You can contribute to steering that ship, or you can lend your will to proxy agents whom you've never been in a room with. Bet on yourself.